Securing an Equity Loan: Actions and Needs Described

Securing an Equity Loan: Actions and Needs Described

Blog Article

The Leading Reasons Property Owners Select to Secure an Equity Funding

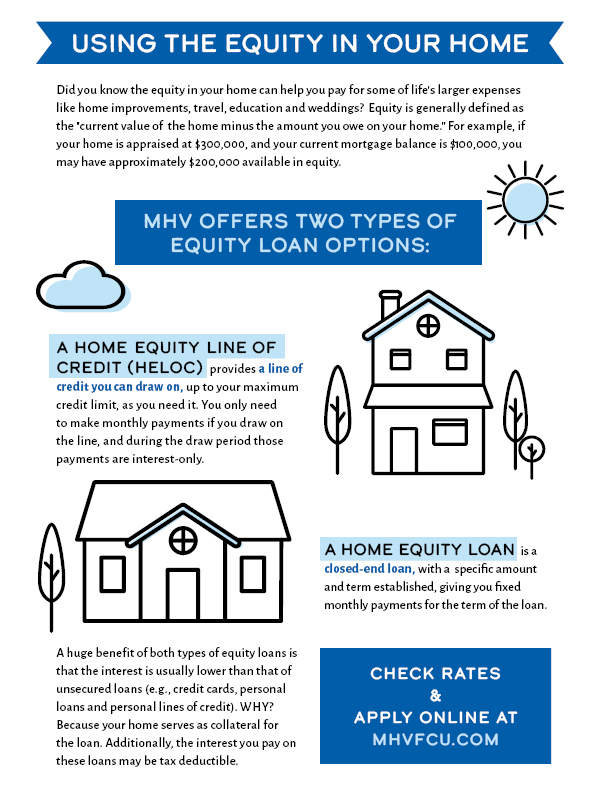

For numerous home owners, picking to protect an equity loan is a strategic monetary decision that can supply various advantages. The ability to tap right into the equity constructed in one's home can supply a lifeline during times of financial need or offer as a device to accomplish certain goals. From consolidating financial debt to undertaking significant home remodellings, the factors driving people to go with an equity finance are impactful and diverse. Recognizing these motivations can clarify the sensible financial planning that underpins such selections.

Financial Obligation Loan Consolidation

Home owners usually choose for safeguarding an equity car loan as a calculated economic move for financial obligation loan consolidation. By leveraging the equity in their homes, individuals can access a round figure of money at a reduced rates of interest contrasted to various other forms of borrowing. This funding can after that be used to pay off high-interest financial debts, such as charge card balances or personal financings, allowing home owners to improve their monetary commitments right into a solitary, much more workable month-to-month payment.

Debt debt consolidation through an equity car loan can use a number of benefits to home owners. The reduced interest price connected with equity loans can result in substantial price savings over time.

Home Enhancement Projects

Considering the boosted worth and performance that can be achieved with leveraging equity, numerous individuals decide to designate funds towards different home enhancement projects - Alpine Credits copyright. House owners typically select to protect an equity loan especially for refurbishing their homes due to the considerable rois that such projects can bring. Whether it's updating outdated features, broadening home, or boosting power efficiency, home improvements can not just make living rooms extra comfy but likewise enhance the general worth of the property

Typical home improvement tasks moneyed with equity financings consist of kitchen remodels, shower room renovations, cellar finishing, and landscaping upgrades. These projects not just boost the lifestyle for house owners however likewise contribute to increasing the curb allure and resale value of the building. Furthermore, buying high-grade products and modern style aspects can further boost the visual charm and capability of the home. By leveraging equity for home improvement jobs, home owners can produce spaces that better match their demands and preferences while likewise making a sound financial investment in their property.

:max_bytes(150000):strip_icc()/dotdash-mortgage-heloc-differences-Final-6e9607c933e9467ba4d676601497a330.jpg)

Emergency Situation Costs

In unforeseen conditions where instant economic support is needed, protecting an equity finance can provide house owners with a sensible option for covering emergency costs. When unanticipated events such as clinical emergency situations, immediate home repair services, or unexpected work loss occur, having accessibility to funds through an my latest blog post equity car loan can provide a safeguard for property owners. Unlike various other forms of borrowing, equity loans typically have reduced passion prices and longer payment terms, making them a cost-efficient alternative for dealing with prompt monetary needs.

One of the key benefits of utilizing an equity funding for emergency costs is the rate at which funds can be accessed - Alpine Credits Home Equity Loans. Property owners can quickly take advantage of the equity developed up in their property, permitting them to address pushing economic issues immediately. Additionally, the versatility of equity lendings allows property owners to borrow only what they require, preventing the burden of taking on extreme financial obligation

Education Financing

Amid the quest of college, safeguarding an equity finance can function as a critical funds for home owners. Education and learning financing is a substantial worry for many family members, and leveraging the equity in their homes can supply a method to gain access to necessary funds. Equity loans often offer lower rates of interest compared to other forms of lending, making them an attractive option for funding education and learning costs.

By touching right into the equity developed in their homes, home owners can access substantial quantities of money to cover tuition charges, publications, accommodation, and other related costs. Home Equity Loan. This can be particularly beneficial for moms and dads looking to support their children with college or people seeking to enhance their own education. Furthermore, the rate of interest paid on equity fundings may be tax-deductible, providing potential financial advantages for debtors

Inevitably, using an equity funding for education and learning funding can assist people spend in their future earning capacity and profession innovation while effectively handling their economic responsibilities.

Financial Investment Opportunities

Conclusion

In verdict, home owners select to safeguard an equity loan for numerous factors such as financial debt combination, home improvement projects, emergency expenses, education funding, and investment opportunities. These lendings offer a method for house owners to accessibility funds for crucial economic demands and goals. By leveraging the equity in their homes, house owners can capitalize on reduced rates of interest and flexible repayment terms to achieve their economic objectives.

:max_bytes(150000):strip_icc()/homeequityloan-e11896bf4ac1475a9806a55f92e0c312.jpg)

Report this page